With so many options, finding the perfect bike loan can be a challenge. The good news is you don’t have to crunch the numbers yourself. Use Aussie Bike Loan’s handy motorcycle loan calculator to figure out your regular loan repayments and find the best bike loan for you.

Why use a motorcycle loan calculator?

A motorbike finance calculator lets you quickly and easily compute your possible loan repayments. Simply input the information and you’ll have an estimated total. You can see how the different factors affect your loan repayments. Knowing how much your repayments cost offers numerous advantages when it comes time to take out a loan.

Benefits of a motorbike finance calculator

Here are just some of the perks of using a motorcycle loan calculator:

Helps you understand your loan repayments

Loan repayments may vary depending on various factors like loan amount, payment frequency, and interest rate. It may be difficult to wrap your head around if you’re new to bike loans. With a bike loan calculator, you can see the difference various factors make to your loan repayments and avoid confusion.

Assist your budgeting

Although the motorbike loan repayment calculator only provides an estimate of your loan repayments, it’s still extremely helpful. You’ll see how different amounts and loan terms can affect your repayment. This gives you a better idea of how much you can afford to create a manageable budget.

Guide your decision-making

It can get overwhelming sorting through so many different loans available. By using a motorcycle finance calculator, you can narrow down your options and figure out which one best fits your situation.

At Aussie Bike Loans, we can take care of all that dirty work. A team of expert brokers, powered by CarLoans.com.au, is here to help you find the best loan. Contact us or get a quick quote online.

How does a bike loan calculator work?

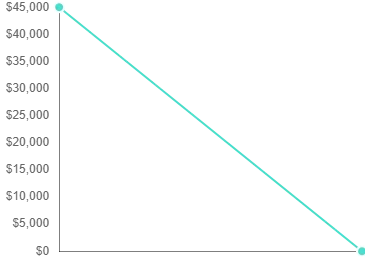

Aussie Bike Loan’s motorcycle finance calculator is straightforward and user-friendly. Your repayments will be calculated based on the loan amount, loan term, loan frequency, interest rate, and balloon payment. All you need to do is input the information and the results will be generated.

Have the following information ready so you can start calculating your possible bike loan repayments:

Loan amount

The loan amount is how much you’re planning to borrow from the lender. For bike loans, you can borrow the full purchase price of the motorcycle, cruiser bike, or dirt bike. These loans don’t usually need a deposit.

Input the amount on the motorcycle loan calculator and see how much you can afford. Modify the calculator’s loan amount to get a better idea of your price range.

Interest rate

Your bike loan’s interest rate depends on your credit score, type of loan, balloon payment, deposit, and other factors. On the motorcycle loan calculator, you can change the interest rate to see how much it will affect your loan repayments.

A loan can have a fixed interest rate or variable interest rate. A fixed interest rate means the interest you pay on your loan stays the same throughout the loan term. The motorbike finance calculator shows your repayments at a fixed interest rate.

On the flip side, a variable interest rate refers to a fluctuating interest rate. You may pay higher or lower rates depending on the state of the market. Get in touch with us to learn more about interest rates on your loan.

Loan term

The loan term refers to the duration of the loan. This is how long you’ll be paying off your loan. In the motorcycle loan calculator, you can choose between three-, four-, or five-year terms. When you change the duration of the loan, you’ll see that your monthly repayments change as well.

If you opt for a longer loan term, you may see lower regular repayments. However, the longer your loan term is, the more interest you have to pay. Discuss the possibilities with an expert broker to see if a longer or shorter loan term is right for you.

Loan payment frequency

With the bike loan repayment calculator, you can choose how often you can make your loan repayments. Know how much you’ll have to pay every week, fortnight, or month. This can help you manage your budget better.

Look at your current income, debt, and the like and see how the different loan payment frequencies can help you make regular repayments.

Initial deposit or trade-in value

When it comes to bike loans, you often don’t need to put down a deposit. However, a deposit or putting up the trade-in value of your current motorbike can be beneficial. When you provide a deposit, lenders will more likely approve your loan application and give you a good rate.

On the motorcycle finance calculator, change the loan amount and vehicle purchase price to see how much your repayments will cost with an initial down payment or trade-in value.

Balloon payment

A balloon payment is a set amount you pay at the end of the loan term. Adding a balloon payment to your bike loan can help lessen your repayments. Using the bike loan repayment calculator, you can see how much a balloon payment can lower your monthly, fortnightly, or weekly payments.

What should you do before taking out a bike loan?

Before you apply for a loan, you need to get your requirements ready. Make sure you have the following documents:

- Identification

- Proof of income

- Bank statements

Lenders will also check your credit score. For the best results, make sure you have good credit. Get a copy of your credit report to make sure everything is in order.

What type of bike is right for you?

Aussie Bike Loans can help you find a loan for different types of bikes. Every bike has a different purpose. See which one fits your lifestyle best:

Motorcycle

A standard motorcycle, also known as a motorbike, is the most common type of motorcycle. The seating is at a medium height and puts riders in a neutral upright position. The weight, size, and engine vary depending on the make and model. These bikes are used to ride on the streets for commuting.

Cruiser bike

A cruiser bike is great for those who want to enjoy a leisurely ride around town. Or go on long scenic adventures down winding roads. With a cruiser bike, the seat puts riders in a low, relaxed position ideal for long rides. It also typically has a low-revving engine with limited suspension and low ground clearance.

Dirt bike

Dirt bikes are built for off-road riding and bike racing. These bikes are not street-legal because they lack basic safety features like mirrors, headlights, and brake lights. If you’re into adrenaline-pumping escapades, a dirt bike could be a good fit.

Buy the perfect bike with the right bike loan

Don’t want to go through the hassle of comparing different bike loans? We can take care of that for you! Aussie Bike Loans is here to help you find the ideal bike loan.

No need to talk to countless lenders and scope out endless loan options. Expert brokers from carloans.com.au will do the heavy lifting. Get in touch with us today by calling 1300 889 669 or get a quick quote online.